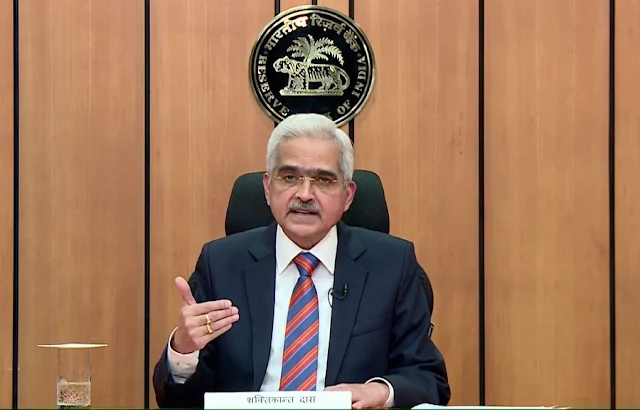

In the fast-paced digital landscape of today, where convenience and innovation reign supreme, a groundbreaking development has emerged from the heart of India's financial sector—the introduction of UPI based Conversational Payments, announced by the Reserve Bank of India (RBI). As we embark on this informative journey, we'll unravel the layers of this transformative concept, exploring its origins, mechanics, and the potential it holds for revolutionizing the way we transact.

The Birth of UPI-Based Conversational Payments

In a visionary move, the Reserve Bank of India recognized the need for a seamless, user-friendly payment solution that capitalizes on the power of Unified Payments Interface (UPI). This led to the birth of UPI-based Conversational Payments, a fusion of cutting-edge technology and human interaction. With this revolutionary offering, RBI aims to redefine the landscape of digital transactions, ensuring that convenience and security walk hand in hand.

The UPI Revolution and Its Evolution

Unified Payments Interface, or UPI, initially introduced in 2016, has since transformed the way Indians transact. Its ability to link multiple bank accounts to a single mobile application paved the way for hassle-free money transfers, bill payments, and more. With the advent of UPI-based Conversational Payments, RBI takes this evolution a step further, introducing a dynamic new way to engage with digital transactions.

Unpacking UPI-Based Conversational Payments

Defining UPI-Based Conversational Payments

UPI-based Conversational Payments can be described as a synergy between UPI technology and real-time chat interactions. This novel approach allows users to initiate payments within a chat or messaging conversation, making the act of sending and receiving funds as effortless as a conversation with a friend.

The Seamless Integration

Picture this: you're chatting with a friend about a dinner plan, and as the discussion unfolds, the need to split the bill arises. UPI-based Conversational Payments enable you to seamlessly execute the payment without leaving the chat interface. The boundaries between conversation and transaction blur, ushering in a new era of interactive financial engagement.

The Promise of UPI-Based Conversational Payments

Redefining Convenience and Security

At its core, UPI-based Conversational Payments promise a two-fold benefit—impeccable convenience and unwavering security. Users can send and receive funds without toggling between apps, all while knowing that UPI's robust security measures are safeguarding their transactions. This seamless blend of ease and protection creates a harmonious digital experience.

Enriching User-Centric Engagement

Beyond the transactional aspect, UPI-based Conversational Payments open doors to personalized engagement. Chat operators, armed with the power of UPI, can offer tailored recommendations, suggest relevant offers, and even facilitate donations—all while maintaining the flow of the conversation. This level of engagement elevates the user experience to new heights.

In the upcoming parts of this series, we'll delve deeper into the mechanics of UPI-based Conversational Payments. We'll explore how these payments are initiated, the role of chat operators, and the technological intricacies that make this innovation possible. Join us as we uncover the inner workings of this transformative concept, brought to life by the visionary approach of the Reserve Bank of India.

Initiating UPI-Based Conversational Payments

Step 1: Chat Initiation

The journey of a UPI-based Conversational Payment begins with a simple chat interaction. Whether you're seeking information, making a purchase, or engaging with customer support, the chat interface serves as the gateway to a world of streamlined transactions.

Step 2: Payment Intent

Within the chat, the user expresses the intent to make a payment. This could range from settling a bill to making a purchase. The chat operator, equipped with the UPI-based Conversational Payments tool, seamlessly transitions from conversation to transaction.

The Role of Chat Operators

Knowledgeable Assistance

Chat operators play a pivotal role in facilitating UPI-based Conversational Payments. Beyond providing information, they guide users through the payment process, ensuring a seamless and hassle-free experience.

Generating Payment Links

When it's time to make the payment, chat operators generate a direct payment link. This link serves as the bridge between the chat conversation and the secure payment gateway, where the transaction will take place.

The Seamless Transaction Journey

User Interaction

Users click on the payment link, initiating the transaction process. The familiar chat interface remains their backdrop, ensuring that the payment remains an integrated part of the ongoing conversation.

Authentication and Verification

As the payment gateway opens, users are guided through authentication and verification steps. This includes providing necessary credentials, two-factor authentication, and any other security measures mandated by UPI.

Confirmation and Completion

Once the payment is successfully authenticated, users receive confirmation within the chat interface. The entire process, from initiating the payment to receiving confirmation, occurs within the same conversation, embodying the essence of UPI-based Conversational Payments.

UPI's Technological Backbone

The UPI Framework

Behind the scenes, the robust UPI framework orchestrates the transaction. It ensures the seamless transfer of funds between the user's bank and the recipient, adhering to the principles of speed, security, and convenience that UPI is known for.

Real-Time Settlement

Thanks to UPI's real-time settlement capabilities, funds are transferred instantly. This rapidity eliminates the need for users to wait for transaction confirmations, enhancing the overall experience.

The Future of UPI-Based Conversational Payments

As we've seen, UPI-based Conversational Payments marry the strengths of UPI technology with the personalized touch of human interaction. This powerful combination has the potential to revolutionize digital transactions, making them not just efficient, but engaging and user-centric.

In the upcoming parts of this series, we'll explore the benefits of UPI-based Conversational Payments for both users and businesses. We'll also dive into the security measures that underpin this innovation, ensuring that your transactions remain as secure as they are convenient.

Empowering Users with Convenience

Swift Transactions

At the heart of UPI-based Conversational Payments lies unparalleled speed. Users can complete transactions within the familiar chat interface, eliminating the need to navigate multiple apps or platforms. Whether you're splitting bills or making purchases, the process is streamlined and instantaneous.

User-Centric Engagement

Engaging with UPI-based Conversational Payments is more than just a transaction—it's an experience. Chat operators provide real-time assistance, making the entire process feel personalized and tailored to your needs.

Boosting Business Efficiency

Seamless Customer Interactions

For businesses, UPI-based Conversational Payments pave the way for seamless customer interactions. Sales and customer support merge effortlessly, creating a holistic experience that fosters loyalty and satisfaction.

Upselling Opportunities

Chat operators, armed with a deep understanding of user preferences, can seize upselling opportunities. Whether it's suggesting complementary products or informing users about ongoing promotions, businesses can enhance their revenue streams.

The Security Paradigm

Robust Security Measures

Security is a paramount concern in the digital realm, and UPI-based Conversational Payments are no exception. UPI's multi-layered security measures, including two-factor authentication and encryption, safeguard transactions, assuring users of a secure environment.

Mitigating Frauds

UPI's stringent security protocols play a pivotal role in mitigating fraudulent activities. With real-time transaction monitoring and rapid alerts, potential threats are detected and addressed promptly, minimizing risks.

The Road Ahead for UPI-Based Conversational Payments

Continued Evolution

As technology evolves, so too will UPI-based Conversational Payments. The integration of artificial intelligence and machine learning holds the potential to further enhance user experiences, making transactions even more intuitive and user-friendly.

A Digital Ecosystem

The introduction of UPI-based Conversational Payments contributes to the growth of a holistic digital ecosystem. It bridges the gap between traditional financial practices and modern, tech-driven solutions, empowering individuals and businesses alike.

Conclusion

In conclusion, UPI-based Conversational Payments, championed by the Reserve Bank of India, signify a remarkable leap forward in the realm of digital transactions. Their ability to seamlessly merge UPI technology with real-time chat interactions creates a landscape that is not only efficient but also engaging and secure.